Global geopolitics is currently being roiled by nationalistic rhetorics. A similar conversation has been going on for some time at the interception of finance and technology. As it goes, financial technology firms, or “fintechs” for short, are aliens of sorts. Traditional banks are being warned that their space is up for “disruption” by these non-natives.

As with geopolitics, the conversation about fintechs is driven by exaggeration of threats, narrow interests and conspiracy theories. Fintechs are not only contesting the space of the banks; they are changing the way financial services are offered and accessed. Given the lower cost of access of services offered by the fintechs, traditional banking faces imminent disrepute. The consumers would soon realise conventional finance is too expensive; and bankers are mainly smart in making money for themselves and their shareholders.

This is one of the two broad impressions that are created with the current depiction of fintechs as financial services disruptors. The other notion, not really less unwelcoming, is that change is being forced on the banks from outside, by entities that are very dynamic, driving an innovation process that will dramatically reconfigure the market.

To exemplify the connotations of financial services disruption, CB Insights – a notable voice in the industry knowledge space – recently said: “Traditional banks are under attack from a number of emerging specialist startups.” It drew chaotic pictures in which virtually all generic banking products and services are being disrupted in the United States and Europe. CB Insights suggested the possibility that fintechs could inflict death by a thousand cuts on the traditional financial services behemoths like Citi, Bank of America and Wells Fargo. The same threat would apply to Europe’s universal banks.

If this were a possibility, it would appear there are concerted efforts to thwart it, just by talking up the threats posed by fintechs. But the possibility of the displacement of conventional banks by fintechs is imagination over-stretched. It is the tenth year since M-Pesa was launched in Kenya. In spite of its success and impact, which are global points of reference, the mobile money transfer service has posed no threat of driving the conventional Kenyan banks into extinction. In 2015, global investment in fintechs reached $19.1 billion. But the same year, US banks alone raised about $140 billion in new capital.

But the displacement of conventional banking services is a possibility already set in motion. The idea that fintechs are forcing changes on conventional banks from outside is true. But the exogenous change process will ultimately prove better than harmless. Fintechs are innovation accelerators. For banking customers, their quests to be served better are being realised. The banks now have a new source of innovative ideas they can adopt. And improved efficiency that new uses of technology is bringing about will serve the interest of bank shareholders better.

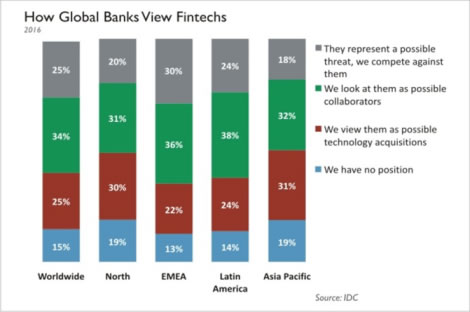

To put it more succinctly, the fintechs disruption is a win-win for all market participants. Innovations by fintechs are driving down cost, boosting financial inclusion, and improving the ease and speed of usage. Fintechs have opened new opportunities for generating new partnerships. Fintechs themselves are acquisition candidates for the banks. In which case, the financial technology companies are the endangered species; not the conventional banking institutions.

Instead of fostering financial innovation – both from internal and exogenous sources – the protection of the turf of the traditional banks have dominated the disruption by fintechs. Therefore, we now have a new industry that is greeted by suspicion, instead of support. In virtually all jurisdictions of the world, one regulatory restriction or another is placed on the service offerings of fintechs, including digital currency, money transfer and crowdfunding. As with crowdfunding and digital currency acceptability in Nigeria, the de facto regulatory restrictions derive from lack of quick response to the need to provide guidelines for the operations of the fintechs.

Forbes estimates that nine out of ten startups fail. Despite the spate of recent fund-raising successes of fintechs, the general narrative is that a lot of the ideas still get stuck at the incubation stage and many others fail to attract growth funds.

It is a mistake to stack the conversations against the fintechs. Compared with the traditional financial institutions, fintechs operate ahead of the innovation curve. But banks have in the main adopted the innovations to launch new services of their own. Since the M-Pesa revolution, Kenyan banks have leveraged mobile banking to increase the penetration of financial services at the bottom of the pyramid. Following the success of ePayment and mobile money solutions by Nigerian fintechs, including eTranzact Plc, Nigerian banks now broadly offer mobile banking. And this is proving to be a new frontier for the realisation of the objectives of the Cashless Policy of Central Bank of Nigeria.

In spite of the wide berth given digital currencies by central banks and other financial regulators, the blockchain has provided the market an innovation to think about. The blockchain, which offshoots from digital currency, is an innovative model for preserving financial transaction records and public disclosure of same. Regulators, including the US Federal Reserve, and some big banks are now considering adoption of or backing for the blockchain technology.

In general, fintechs are helping to widen the digital footprints of financial transactions. As an example, in the past, international money transfer data was mainly provided by the senders. Very little was known about the recipients. Local money transfer – mainly through person-to-person, with all its risk of failed delivery – happened under the radar of formal transaction reporting. But with mobile money transfer, the recipients are no longer anonymous. SIM registration enables data mining, on the users (sender and receiver) and the transaction. This is an important contribution to big data, which will help in the development of artificial intelligence needed in developing more personalised financial products and services of the future.

It is true, but not worrisome: fintechs have unleashed a new era of competition in the financial services industry. Banks no longer compete only among themselves. Fintechs are in the fray and have introduced a higher level of dynamism that is a boost to productivity and efficiency. The advent of fintechs has meant that banks can no longer ignore or respond as slowly as they used to do to the demand of their customers for convenience and lower cost of accessing financial products and services.

In general, fintechs are now part of the financial services ecosystem. The conversation on financial disruption can no longer be about bulwarking the conventional banks against intrusion of fintechs. There is need to drum up support for the new entrants that have proved so useful in boosting access and efficiency in financial services provisioning.

According to the December 2016 post by Marco Antonio Cavallo on CIO.com: “The Fourth Industrial Revolution brought the convergence of the physical and cybernetic worlds, and the digital technologies that came along with it have created new paths of innovation that have disrupted the once known as the most traditional business model: the financial services industry.” This revolution is just incepting and will continue to gain ground.

However, some of the negative impacts of digitalisation, robotics and 3D printing – especially labour displacement – are issues that cannot be glossed over. Academic economists are already discussing how to mitigate the negative impacts, including through income redistribution. Fintechs are not likely to be job-richer than their cousins in the social media. But there is much more to lose from hampering this wind of innovation from blowing.